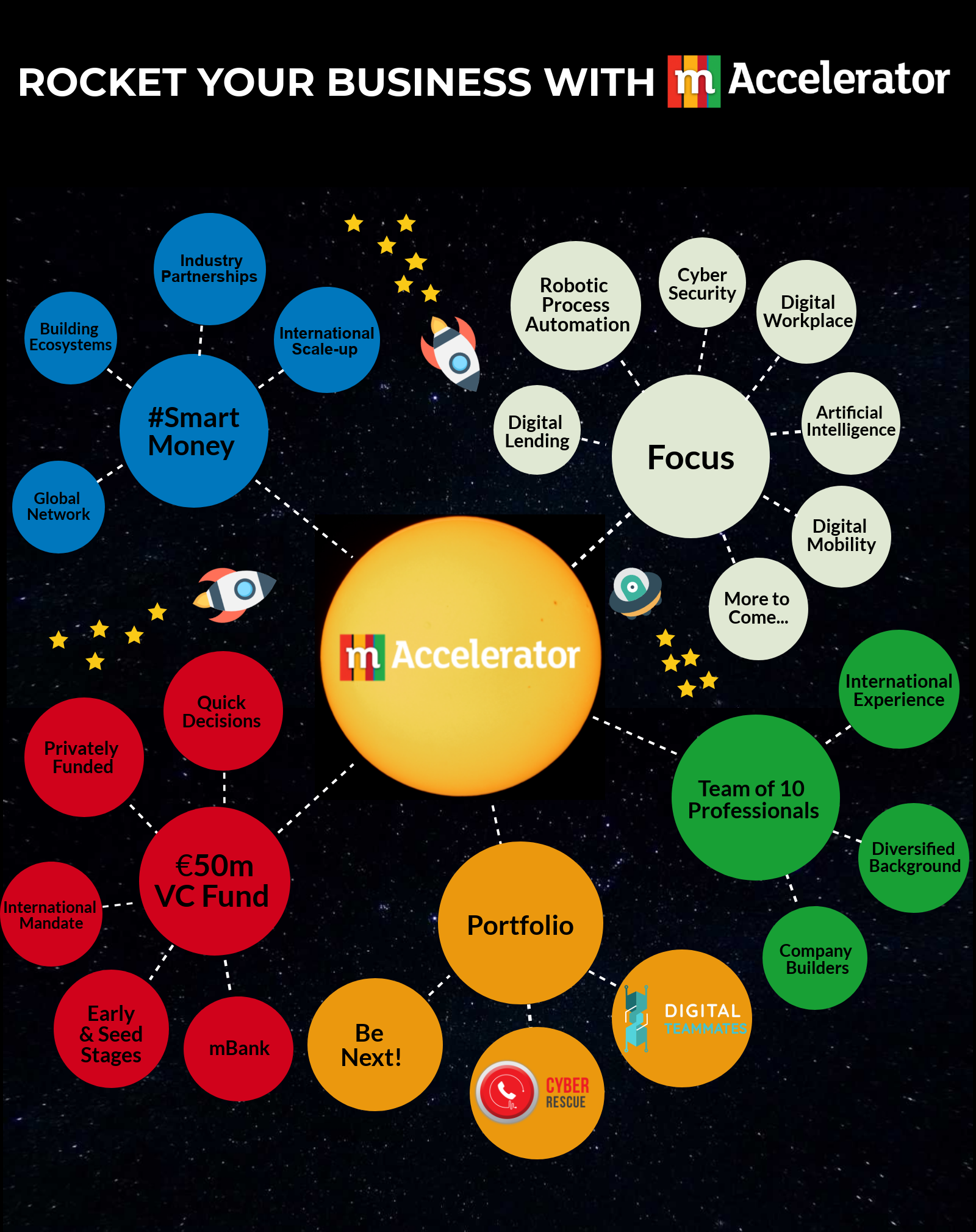

Meet mAccelerator, Polish €50m VC fund

2017

Dec 28

Dec 28

In November, we – Wojciech and Maciek from mAccelerator, a Polish EUR 50m VC fund – visited Startup Lithuania during our one-day visit in Vilnius. We came to meet with prospective startups and stopped by in the Startup Lithuania’s hub (which, by the way, has really amazed us for its vintage look and beautiful location) to learn the organization’s views on the local startup landscape. We had inspiring 1-hour chat with Mantas Kondratavičius responsible for business development exchanging insights and latest startup trends in Lithuania and Poland. The discussion has left us very enthusiastic of how robust and well-connected Lithuanian startup ecosystem appears to be. We ended our talk with a conclusion that given our portfolio-building stage our VC fund might be a great match for Lithuanian startups. Hence our introduction in this newsletter.

At mAccelerator we engage in seed investments as well as later-stage investments in startups with solutions applicable to the banking and financial sectors, currently focusing on cybersecurity, biometry, robotic process automation, artificial intelligence and digital marketing. We place no limit on the geographical presence of a prospective startup and seek investments with tickets ranging from €100k to a maximum of €9m EUR. Our team members are deep-rooted in the banking industry with the fund’s partners having previously assumed high managerial positions at financial institutions. Apart from banking, our experience also includes company-building, consulting, investment banking and law.

We are backed by mBank, a fourth largest banking group in Poland with over 5.3m retail clients and 21k corporate clients operating in Poland, Czech Republic and Slovakia. We really appreciate this corporate partner, since mBank sets direction of the mobile and on-line banking development in Poland and abroad (which is proven by international acclaim and rewards) and offers a range of collaborative options for our portfolio startups.

Given the above, we identify ourselves as smart money – apart from growth capital we provide sector knowledge and expertise together with a range of partnership options with a major Polish bank and other corporates from our wide network. With those attributes, we aim to be a long-term partner to the startups we support.

Currently, our portfolio contains 2 companies: CyberRescue (cybersecurity solution based on passive biometrics) and Digital Teammates (pure-play Robotic Process Automation company).

If you think your startup has the unicorn particle and you would like to learn more about our VC fund contact Maciek directly at [email protected] or apply via our website https://maccelerator.vc/.